In Cato VI an Anti-Federalist author discusses issues with the apportionment of taxes and representation in the US Constitution.

All tagged Taxes

John Fries' Rebellion - America's Third Anti-Tax Revolt

John Fries was a Continental Army veteran who started a rebellion when President Adams decided to collect taxes.

Founding Taxman - Joseph Neville and the Whiskey Rebellion

Joseph Neville attempt to collect taxes from farmers in western Pennsylvania began the tension which led to the Whiskey Rebellion.

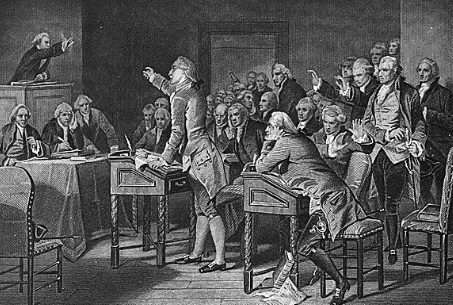

Future Founders - The 11 Most Important Stamp Act Congress Delegates

A list of the Stamp Act Delegates who went on to contribute the most during the American Revolution that followed.

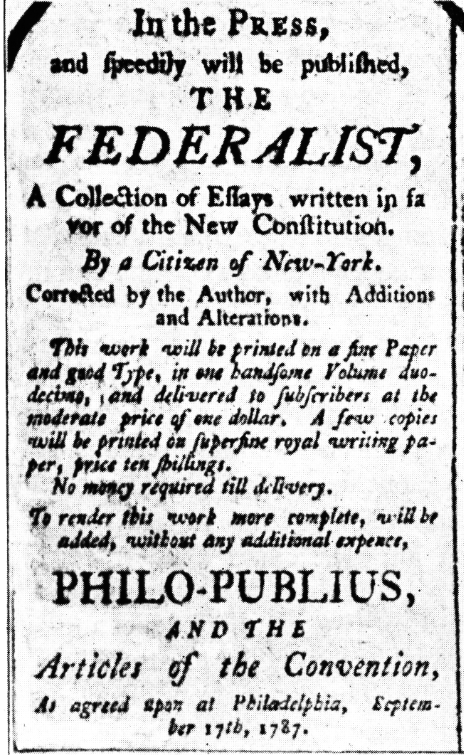

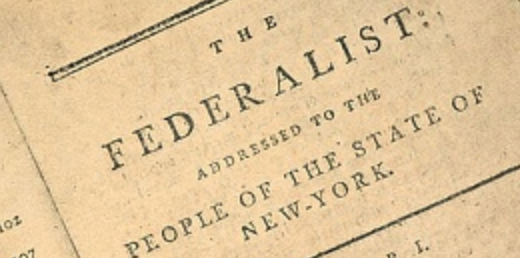

Together Yet Independent - The Contradiction of Federalist #36

In Federalist #36, Alexander Hamilton sums up his argument for the Federal Government’s ability to issue internal taxes plus adds a strange contradiction.

Altogether Visionary - Equality, Taxation and Federalist #35

In Federalist #35 Alexander Hamilton discusses equality of taxation as well as class representation in Congress.

Sharing Power - Federalist #34

In Federalist #34 Alexander Hamilton discusses the sharing of power between the State and National Governments. Specifically, he relates these powers to taxation.

Sharing Power - Hamilton's Understanding of Taxation - Federalist #32

In Federalist #32, Alexander Hamilton argues that the Constitution’s taxing powers do not take away from the State’s power to raise funds.

Hamilton Rolls His Eyes - Federalist #31

In Federalist #31, Alexander Hamilton reprimands the Anti-Federalists for thier opposition to the Constitution’s ability to raise taxes.

Tax The People Directly - Alexander Hamilton's Federalist #30

In Federalist #30, Alexander begins his discussion on why direct taxation is necessary for the success of the United State.